69%

Think their employer should do more to support their personal finances

1 in 5 employees says they will look for a new, higher-paying job in the next 12 months if the cost of living crisis worsens. With financial stress and staff retention strongly linked, it pays to invest in your current team.

67% of employees say money worries affect their work...

.png)

...of which, 59% say it makes them less productive.

Employees with money worries also take more sick days, feel undervalued and actively look for higher-paying jobs.

%20do%20money%20worries%20have%20on%20employees%20work_%20(1).png)

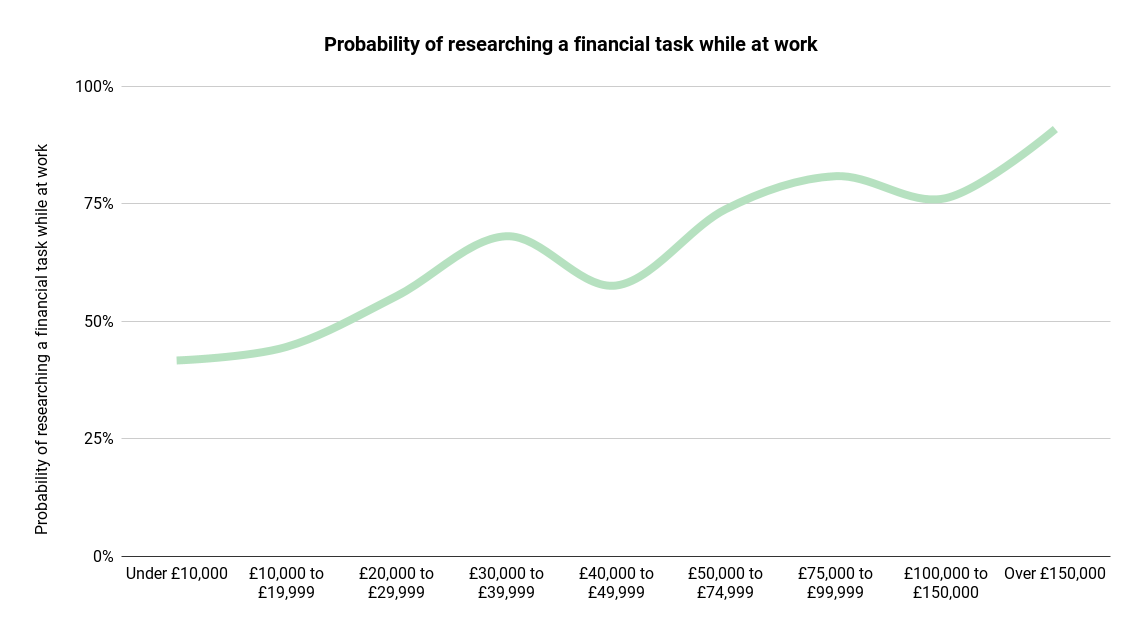

And it’s not just the lowest paid who are impacted.

It’s your entire workforce.

In fact, the more an employee earns, the more likely they are to spend time on a personal financial task, while at work.

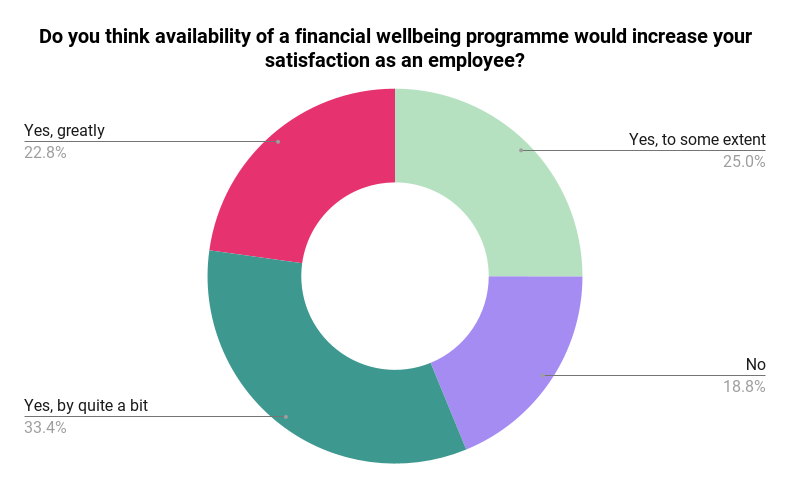

All the while, an overwhelming 81% of employees say a financial wellbeing programme would increase their satisfaction.

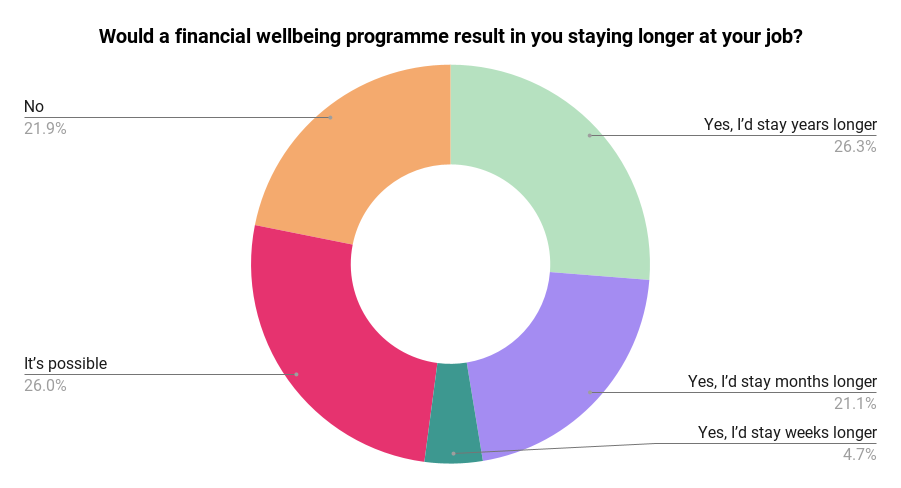

It could even see them stay longer at your company.

Many employees even know what kind of support they’re after.

.png)

There are clear signs financial education and wellbeing programmes provide a big opportunity for employers, when competing for talent.

Think their employer should do more to support their personal finances

Would welcome their employer offering guidance that helps them save money every month

Would use a financial wellbeing programme, if their employer offered it

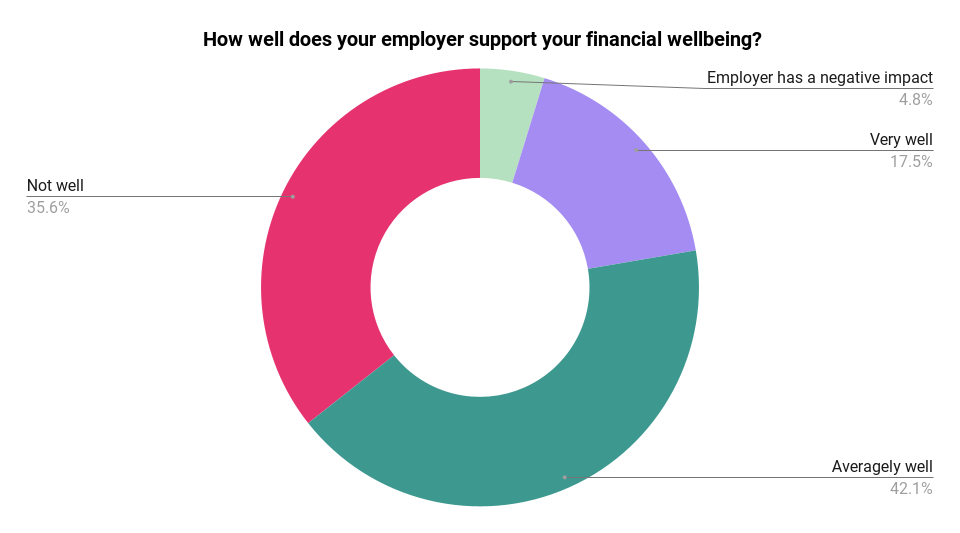

And, so far, few employers have managed to get it right.

19% increase in pension income per year

39% increase in financial asset value

£47k average monetary benefit after 10 years

10% feel less stressed about the future

44% feel more confident about managing their money

28% feel more secure after putting a financial plan in place

Jan 15, 2024 by Oliver Gudgeon

Blue Monday (15 January) has a mixed reputation. But there’s still value in using the day to raise awareness of mental...

Nov 23, 2023 by Oliver Gudgeon

Ever wished you had a money-whiz friend you could ask anything, as often as you like?

That's exactly what Claro...

Nov 6, 2023 by Rob Brockington

Millions are being impacted by financial stress. Yet, until now, workers in frontline occupations have not been able to...

Data has been taken from ONS, MAPS, YouGov, PWC.