Compare Claro Wellbeing

Organisations often struggle when choosing the best financial wellbeing provider for their people's needs. As a result, great employees end up putting sticking plasters over sore spots in their finances, rather than improving their financial health. Use this guide to identify whether Claro Wellbeing is right for you.

Claro Wellbeing, at a glance

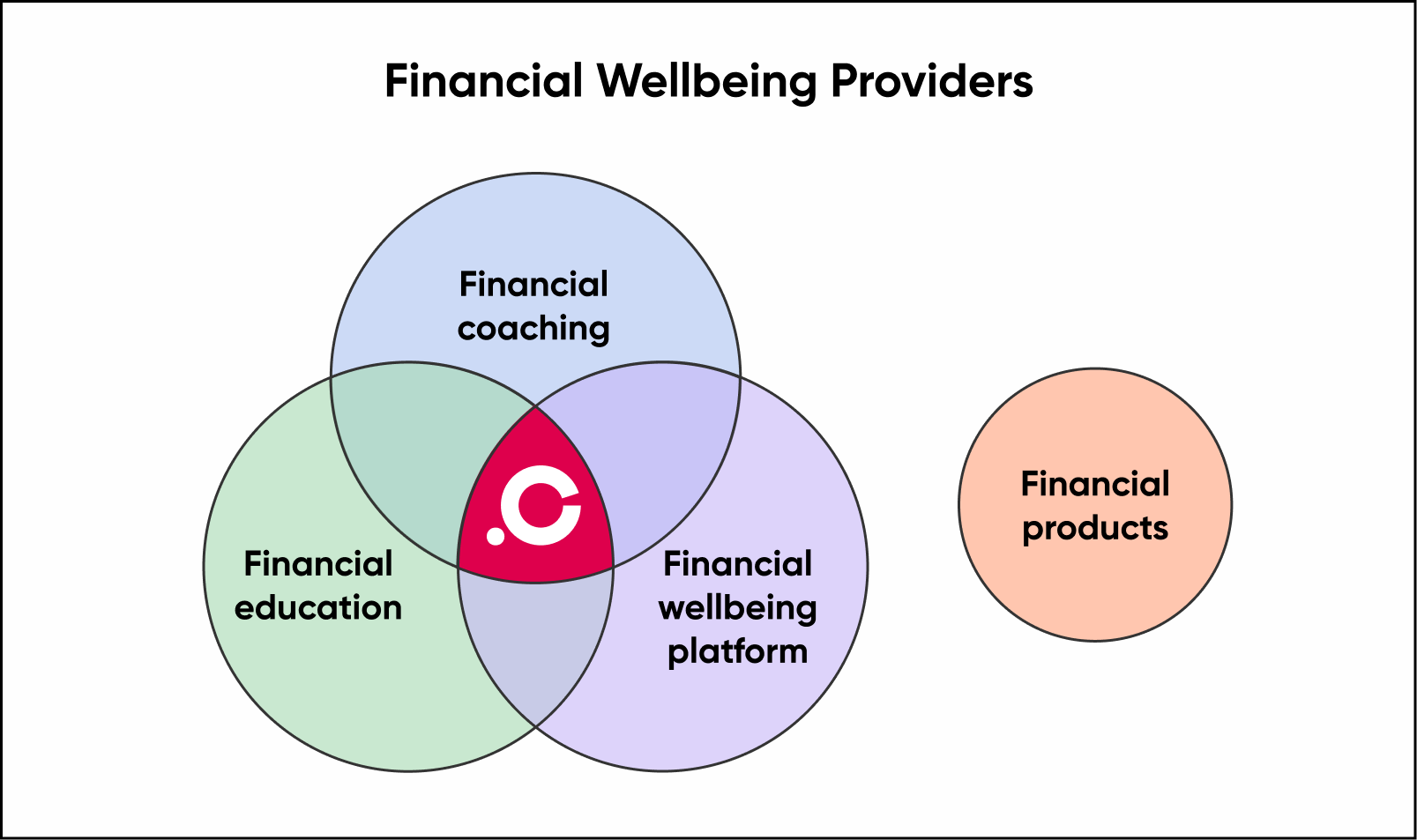

Claro Wellbeing remains impartial by not selling any financial products to your team.

Compare Claro Wellbeing

Use this chart to see how Claro Wellbeing compares to similar financial wellbeing providers. Chart data is based on general information, accessed via publicly available sources.

Other financial wellbeing providers |

Claro Wellbeing |

|

|

1-2-1 financial coaching |

✅ |

✅ |

|

—Coaches employed in-house |

❌ |

✅ |

|

—Coaches trained with The London Institute of Banking & Finance-accredited programme |

One provider only |

✅ |

|

—Sessions offered via both Zoom and WhatsApp |

❌ |

✅ |

|

—Continuing Professional Development (CPD) hours |

Some providers |

✅ |

|

Webinars and workshops |

✅ |

✅ |

|

—Interactive "Finance Friday" workshops, as featured in The Guardian |

❌ |

✅ |

|

Analytics dashboard |

✅ |

✅ |

|

—Aggregated metrics data, configured to your needs |

❌ |

✅ |

|

On-demand educational content |

✅ |

✅ |

|

—Complete personal finance education platform, created by expert financial coaches |

❌ |

✅ |

|

Budgeting tools and calculators |

✅ |

✅ |

|

—See all bank accounts in one place with open banking-enabled budgeting tool |

✅ |

✅ |

|

—See your budget pie chart and spending traffic |

❌ |

✅ |

|

Rewards |

❌ |

✅ |

|

Completely available internationally |

Generic content providers, rewards platforms and insurers only |

🚀

|

|

Priced per employee per month (PEPM) |

✅ |

✅ |

Methodology

In January 2023, market research was carried out using publicly available information on six other financial wellbeing providers that offer financial education and coaching: Octopus Money Coach, Nudge, Otto Finance, Bippit, MyEva and Maji.

See how Claro Wellbeing compares to other types of financial wellbeing providers

Compare Claro Wellbeing to other companies that offer financial wellbeing. These charts was created using general information from publicly available sources.

| Product providers | Claro Wellbeing | |

|

Don't sell your team financial products |

❌ | ✅ |

|

Impartial guidance and education |

❌ | ✅ |

|

1-2-1 financial coaching |

One provider only |

✅ |

|

—Coaches employed in-house |

❌ | ✅ |

|

—Coaches trained with The London Institute of Banking & Finance-accredited programme |

❌ | ✅ |

|

Webinars and workshops |

❌ | ✅ |

|

On-demand educational content |

One provider only |

✅ |

|

—Complete personal finances education platform, created by expert financial coaches |

❌ | ✅ |

|

Budgeting tools and calculators |

One provider only |

✅ |

|

—See all bank and credit accounts in one place with open banking-enabled budgeting tool |

✅ | ✅ |

|

—See your budget pie chart and spending traffic lights |

❌ | ✅ |

|

Analytics dashboard |

❌ | ✅ |

|

—Aggregated metrics data, configured to your needs |

❌ | ✅ |

|

Rewards |

❌ |

✅ |

|

Available globally |

Most providers |

🚀 Go on a journey with us |

Methodology

In January 2023, market research was carried out using publicly available information on three providers: Salary Finance, Cushon and Wagestream.

| Pensions and insurance providers | Claro Wellbeing | |

|

Don't sell your team pensions and insurance |

❌ | ✅ |

|

Impartial guidance and education |

❌ | ✅ |

|

1-2-1 financial coaching |

One provider only |

✅ |

|

—Coaches employed in-house |

❌ | ✅ |

|

—Coaches trained with The London Institute of Banking & Finance-accredited programme |

❌ | ✅ |

|

Webinars and workshops |

One provider only |

✅ |

|

On-demand educational content |

One provider only |

✅ |

|

—Complete personal finances education platform, created by expert financial coaches |

❌ | ✅ |

|

Budgeting tools and calculators |

One provider only |

✅ |

|

—See all bank and credit accounts in one place with open banking-enabled budgeting tool |

❌ | ✅ |

|

—See your budget pie chart and spending traffic lights |

❌ | ✅ |

|

Analytics dashboard |

❌ | ✅ |

|

Rewards |

❌ |

✅ |

|

Available globally |

❌ |

🚀 Go on a journey with us |

Methodology

In January 2023, market research was carried out using publicly available information on two pensions and insurance providers: WEALTH at work and Hub Financial Solutions.

| Employee assistance programmes (EAP) providers | Claro Wellbeing | |

|

Don't sell your team financial insurance and pensions |

❌ | ✅ |

|

1-2-1 financial coaching |

One provider only |

✅ |

|

—Coaches employed in-house |

❌ | ✅ |

|

—Coaches trained with The London Institute of Banking & Finance-accredited programme |

❌ | ✅ |

|

Webinars and workshops |

✅ | ✅ |

|

On-demand educational content |

One provider only |

✅ |

|

—Complete personal finances education platform, created by expert financial coaches |

❌ | ✅ |

|

Budgeting tools and calculators |

❌ | ✅ |

|

Analytics dashboard |

✅ | ✅ |

|

—Aggregated metrics data, configured to your needs |

One provider only |

✅ |

|

Rewards |

✅ |

✅ |

|

Cashback |

✅ | ❌ |

|

Available globally |

✅

|

🚀 Go on a journey with us |

Methodology

In January 2023, market research was carried out using publicly available information on three employee assistance programmes: YuMatter (by YuLife), LifeWorks and Vivup.

| Rewards/discount platforms | Claro Wellbeing | |

|

Rewards |

✅ |

✅ |

|

Cashback |

✅ | ❌ |

|

1-2-1 financial coaching |

❌ | ✅ |

|

On-demand educational content |

✅ | ✅ |

|

—Complete personal finances education platform, created by expert financial coaches |

❌ | ✅ |

|

Webinars and workshops |

✅ | ✅ |

|

—Interactive "Finance Friday" sessions, as featured in The Guardian |

❌ | ✅ |

|

Budgeting tools and calculators |

✅ | ✅ |

|

—See all bank accounts in one place with open banking-enabled budgeting tool |

❌ | ✅ |

|

—See your budget pie chart and spending traffic lights |

❌ | ✅ |

|

Analytics dashboard for employers |

✅ | ✅ |

|

—Aggregated metrics data, configured to your needs |

❌ | ✅ |

|

Available globally |

✅ | 🚀 |

Methodology

In January 2023, market research was carried out using publicly available information on three rewards platforms: Perkbox, Reward Gateway and Sodexo.

Attract and retain great talent — without hurting your bottom line

Start bolstering your team’s financial health today.

69% |

say their employer should do more to support their personal finances |

78% |

say their employer is doing either an average or below job of looking after their finances |

76% |

say if their employer offered a financial wellbeing benefit, they’d use it |