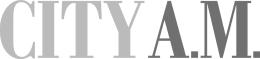

26%

lack affordable options for personal finance help

Claro Wellbeing is on a mission to boost the financial health of millions of deskless UK workers – through education, guidance and coaching.

Claro Wellbeing was founded upon an unshakeable belief that financial education should be democratised.

Today, technology gives us the power to open a bank account faster than the earth can fully rotate, buy dinner abroad without extortionate exchange fees, and invest in digital currencies named after memes.

But levels of financial literacy have not kept pace with financial-technological innovation. Too few of us are taught essential financial skills at school or at work. As a result, many of us face barriers when seeking help.

lack affordable options for personal finance help

say financial advisers too expensive

don’t know where to find help

If technology can empower our finances, it can empower our financial education, too.

So, at Claro Wellbeing, we’re bringing financial wellbeing to all, by providing the education, guidance and tools to help everyone take control of their money.

Trained with a programme accredited by an industry-leading institution, Claro Wellbeing's coaches set the benchmark for financial coaching.

of Claro financial coaching delivered

of experience in financial advice

of experience in the financial services industry

All coaches are employed by Claro

Experience in the UK, Europe, Australia and the Middle East

69% |

say their employer should do more to support their personal finances |

78% |

say their employer is doing either an average or below job of looking after their finances |

76% |

say if their employer offered a financial wellbeing benefit, they’d use it |