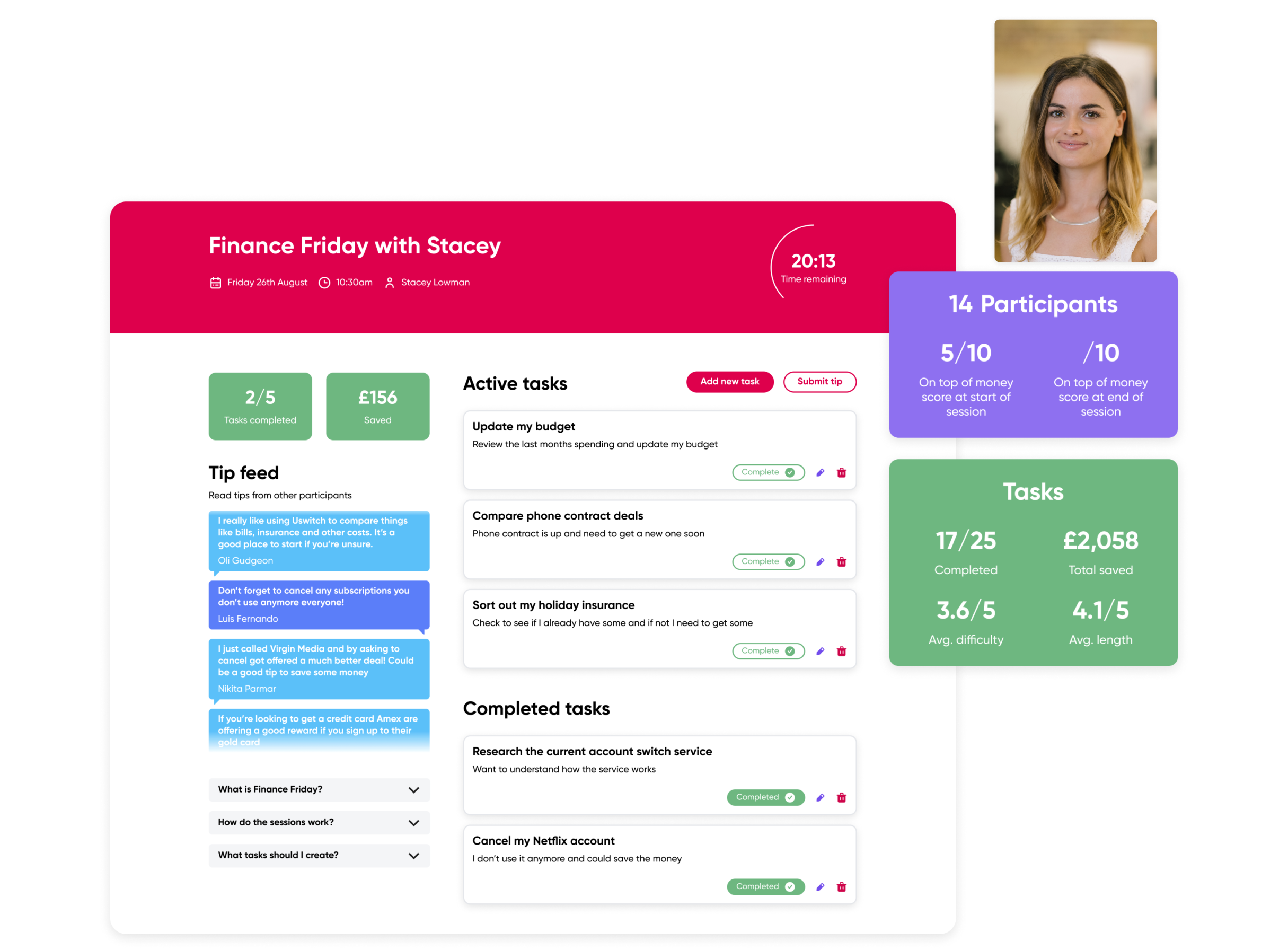

Introducing: Finance Friday sessions

On Finance Friday – the last Friday of the month – you join a 45-minute session to make progress on your personal finances, one bite-sized task at a time.

See full platform

A tiny monthly commitment with a massive pay-off

Available as part of your full financial wellbeing platform subscription, Finance Friday sessions help your employees get on top of the financial tasks they've been meaning to complete. Meet the fun and collaborative way to take control of personal finances.

Get together over video and complete personal finance tasks

Guided by a Claro Wellbeing expert financial coach, Finance Fridays are supportive sessions to help your employees tackle their personal finances.

- Log into the Claro Wellbeing platform to create tasks you want to complete

- Join your expert financial coach and colleagues over Zoom

- Become accountable together while sharing only what you're comfortable with

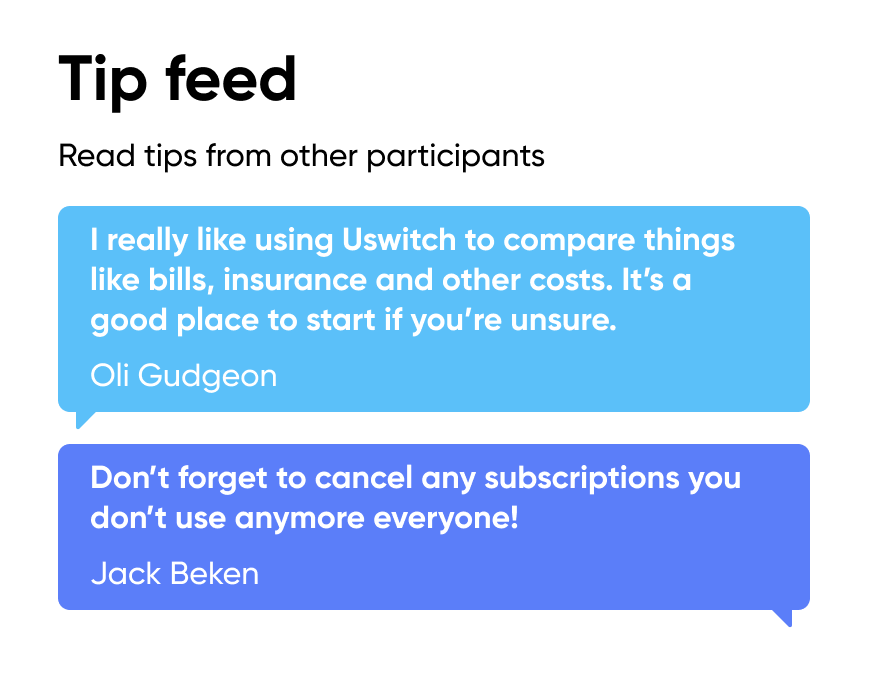

Share and uncover new financial insights

Got a tip to share with your team? Share it in the tip feed, while reading those shared by others.

- Fosters a positive culture around money through uncovering shared learnings

- Help your team discover different ways to tackle money problems, while being safely guided by a certified financial coach

- Increase the adoption of existing benefits, by creating opportunities to be reminded of their value

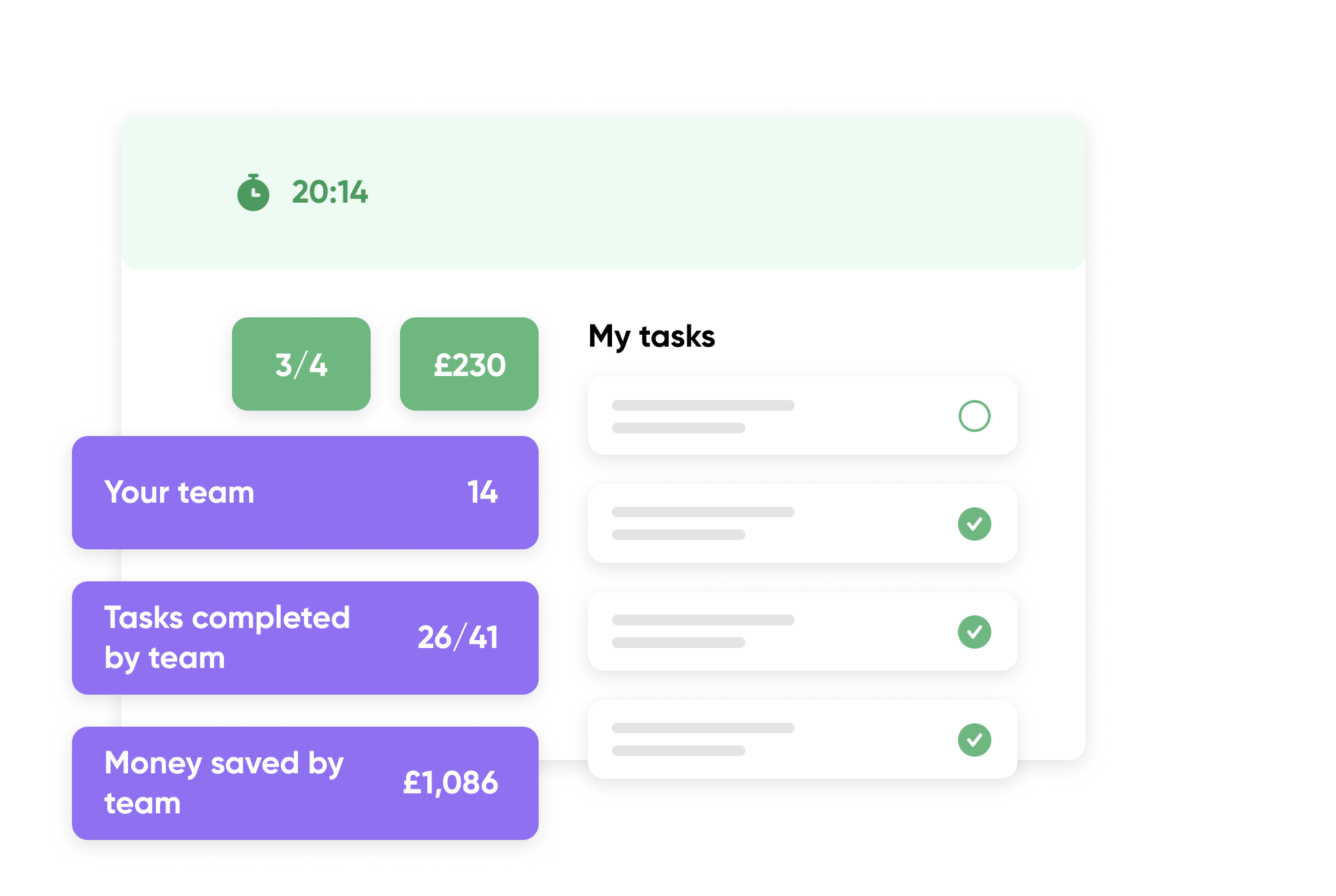

Celebrate your wins together and see what you can achieve

Finish the session by sharing your progress and celebrating your wins together.

- See the positive impact of each Finance Friday session on your team's personal finances at the end of every session

- Easily see the return on investment (ROI) of each session, making reporting to stakeholders a breeze

- Encourage gamification of financial health and keep up the momentum on bringing financial health to your team

As seen in

Attract and retain great talent — without hurting your bottom line

Start bolstering your team’s financial health today.

69% |

say their employer should do more to support their personal finances |

78% |

say their employer is doing either an average or below job of looking after their finances |

76% |

say if their employer offered a financial wellbeing benefit, they’d use it |